Sunk Cost Fallacy

Your progress on this bias test won't be saved after you close your browser.

Understanding Sunk Cost Fallacy

Sunk Cost Fallacy

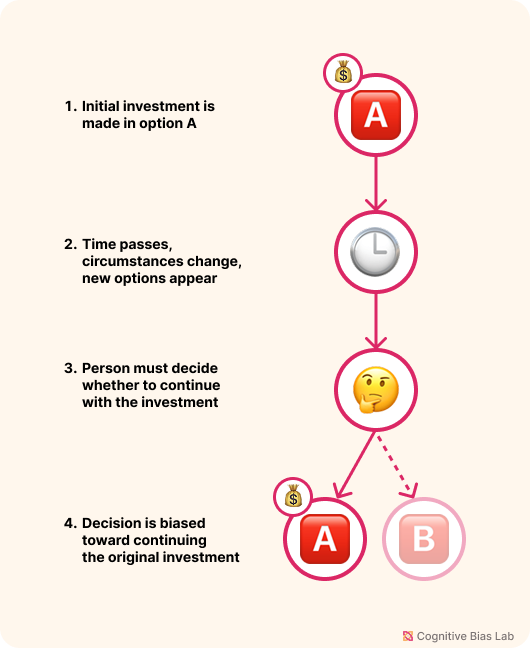

The tendency to stick with a decision because of money, time, or effort already spent, even when it no longer makes sense to continue.

What It Is

This bias occurs when people continue a behavior or endeavor because they have already invested time, money, or resources, even when continuing no longer benefits them. Instead of making decisions based on future outcomes, they become anchored to what has already been lost — costs that cannot be recovered.

Why It Happens

People often fall into this trap due to a mix of emotional and cognitive forces. Loss aversion makes it painful to accept that a previous investment is gone, so continuing feels like avoiding a loss. There is also a strong need to stay consistent with past decisions, which creates pressure to justify the original choice rather than revise it.

Emotions play a role too. Admitting a mistake can trigger regret or embarrassment, so people convince themselves to keep going in the hope that things will improve. These tendencies cause decisions to be based on sunk effort, not on actual value moving forward.

Everyday Impact

This pattern shows up across many areas of life:

In personal decisions, someone might finish an overpriced, unsatisfying meal simply because they paid for it. Others may stay in unhappy relationships or unfulfilling jobs because they have already invested years of time and energy.

In professional and organizational contexts, companies and governments often continue funding failing projects just to justify previous spending. This kind of thinking leads to resource misallocation and missed opportunities, often with significant financial or social consequences.

The Cost of Clinging

By letting past costs dominate their reasoning, people risk making decisions that trap them in a cycle of waste and regret. Recognizing that past investments cannot be recovered is essential for clear-headed thinking. The most rational choice is not the one that tries to validate past decisions, but the one that maximizes future benefit.

Visual representation of Sunk Cost Fallacy (click to enlarge)

Examples of Sunk Cost Fallacy

Here are some real-world examples that demonstrate how this bias affects our thinking:

Psychological Study Simulation

The Sunk Cost Fallacy

Experience how past investments can irrationally influence our decisions in this recreation of Arkes & Blumer's 1985 study. You'll face two scenarios involving movie tickets and bad weather.

Unwatchable series commitment

You've started watching a highly-rated streaming series and completed six episodes out of ten, but find it increasingly boring and not to your taste. Despite having hundreds of other shows you'd rather watch, you continue to the end because you've already invested several hours. The rational choice would be to switch to something you enjoy, since the time already spent is gone forever regardless of whether you finish the series or not.

Project persistence

Your company has invested $2.4 million and 18 months developing a new software product. Recent market research shows that competitors have released similar products that are better received and cheaper. Despite clear evidence that continuing will lead to financial losses, management decides to invest another year and $1 million because "we've come too far to give up now." This decision ignores future prospects and focuses solely on past investments.

Degree dilemma

After three years studying a specialized degree, you realize you have no passion for the field and job prospects are poor. Despite having one year remaining, you decide to finish rather than switch to something you'd enjoy, thinking, "I can't waste all those credits and tuition." This ignores that the additional year could be better invested in a more fulfilling direction, since the previous three years are a sunk cost either way.

How to Overcome Sunk Cost Fallacy

Here are strategies to help you recognize and overcome this bias:

Conduct zero-based thinking

Regularly ask yourself: "Knowing what I know now, would I start this project/relationship/activity again today?" If the answer is no, it might be time to cut your losses. This mental reset helps eliminate the psychological weight of past investments.

Calculate opportunity costs

When facing a sunk cost decision, explicitly calculate what else you could do with your future resources (time, money, energy) if you abandoned the current path. This shifts focus from what you've already spent to what you could gain elsewhere.

Test Your Understanding

Challenge yourself with these questions to see how well you understand this cognitive bias:

A company has spent $3.5 million developing a product when a competitor releases a superior version at half the expected price. What would most clearly demonstrate the sunk cost fallacy?

Academic References

- Arkes, H. R., & Blumer, C. (1985). The psychology of sunk cost. Organizational Behavior and Human Decision Processes, 35(1), 124–140.

- Wang, Chenyu and Wormwood, Jolie and Bicchieri, Cristina, The Social Fabric of Sunk Costs: The Role of Social Norms in the Sunk Cost Fallacy (December 19, 2024).

- Tetteh, A. N., Weng, Q. D., Simeonova, B., Hughes, M., & Tayyab, H. H. (2024). The Fallacy of Sunk Cost:The impact of investors’ sunk cost on reinvestment in underperforming firms. Academy of Management Proceedings, 2024(1).