Hindsight Bias

Your progress on this bias test won't be saved after you close your browser.

Understanding Hindsight Bias

Hindsight Bias

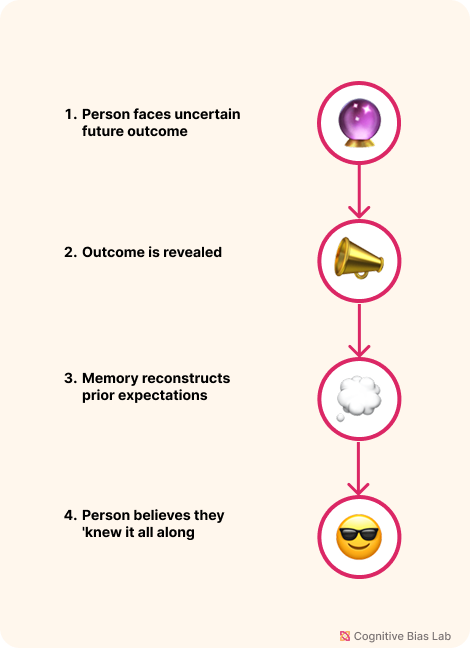

We often claim events were predictable after they've happened. That nagging feeling of 'I knew it all along' can distort our memory of uncertainty and lead us to overestimate our forecasting abilities.

Overview

Hindsight bias occurs when we convince ourselves that we could have predicted past events, despite having faced genuine uncertainty before they occurred. This mental distortion makes us believe we're better forecasters than we actually are—a dangerous illusion that affects everyone from investors to executives.

Key Points:

- The classic "I knew it all along" effect transforms unpredictable events into seemingly obvious outcomes in our memory.

- This bias erases our recollection of uncertainty that existed before the event occurred.

- It creates a false sense that the world is more predictable than it truly is.

- Professionals often overestimate their foresight and undervalue the role of chance in outcomes.

Impact: Hindsight bias undermines learning from experience. When we believe outcomes were inevitable, we fail to appreciate the genuine uncertainty we faced. This can lead to overconfidence in future predictions and missed opportunities to improve decision-making processes.

Practical Importance: By recognizing hindsight bias, we can maintain intellectual humility, develop more realistic risk assessments, and create more robust contingency plans. This awareness helps us become better decision-makers who learn effectively from both successes and failures.

Visual representation of Hindsight Bias (click to enlarge)

Examples of Hindsight Bias

Here are some real-world examples that demonstrate how this bias affects our thinking:

Psychological Study Simulation

Hindsight Bias

Experience how knowing the outcome of an event affects your perception of its predictability. This simulation recreates the classic 'knew-it-all-along' effect studied by Fischhoff.

Market Crash Retrospective

After a major stock market crash, financial analysts confidently explain how it was clearly inevitable due to certain economic indicators. Yet these same experts had failed to predict the crash beforehand, despite having access to the same information. The selective memory of warning signs and forgetting of contradictory evidence demonstrates how hindsight bias rewrites our perception of predictability.

Product Launch Failure

A tech company launches a new product that unexpectedly flops. During the post-mortem meeting, team members claim they always had concerns about features that customers rejected. However, review of pre-launch documentation shows these same features were unanimously approved and concerns were never raised. The team has unconsciously rewritten their memories to align with the known outcome, illustrating how hindsight bias distorts organizational learning.

How to Overcome Hindsight Bias

Here are strategies to help you recognize and overcome this bias:

Maintain Decision Journals

Record your reasoning, predictions, and rejected alternatives before key decisions. Reviewing these notes later helps counter hindsight bias by revealing what you actually anticipated at the time.

Conduct Premortem Analyses

Before starting a project, imagine it has failed and identify possible reasons. This approach surfaces hidden risks early and guards against the false certainty hindsight can create.

Test Your Understanding

Challenge yourself with these questions to see how well you understand this cognitive bias:

A pharmaceutical company's new drug fails in final clinical trials. The CEO claims 'the warning signs were obvious.' What cognitive error is occurring?

Academic References

- Fischhoff, B. (1975). Hindsight is not equal to foresight: The effect of outcome knowledge on judgment under uncertainty. Journal of Experimental Psychology Human Perception & Performance, 1(3), 288–299.

- Roese, N. J., & Vohs, K. D. (2012). Hindsight bias. Perspectives on Psychological Science, 7(5), 411–426.

- Hindsight bias | EBSCO. (2024). EBSCO Information Services, Inc.