Bandwagon Effect

Your progress on this bias test won't be saved after you close your browser.

Understanding Bandwagon Effect

Bandwagon Effect

We tend to adopt beliefs or behaviors simply because many others do the same. This conformity impulse can override our independent judgment, causing us to make decisions based on social proof rather than personal evaluation.

Overview

Bandwagon effect occurs when people adopt beliefs, ideas, or behaviors primarily because others are doing so, regardless of their own independent analysis. This psychological phenomenon is driven by our natural desire to conform and belong to groups.

Key Points:

- The prevalence of an opinion is often mistaken as evidence of its validity or value.

- This bias is especially powerful in election campaigns, consumer trends, social media, and investment decisions.

- The stronger the perceived majority, the more powerful the pressure to conform becomes.

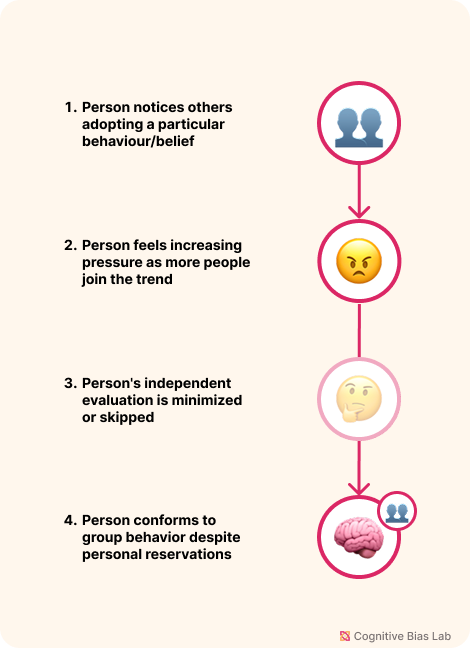

How It Works: The bandwagon effect operates through two primary mechanisms: social proof (assuming others' actions reflect correct behavior) and fear of exclusion (concern about being left out or judged for holding minority views). Both mechanisms can bypass critical thinking and lead to decisions that may not align with one's actual preferences or best interests.

Practical Importance: Recognizing the bandwagon effect is crucial for maintaining intellectual independence and making decisions based on their actual merits rather than their popularity. In contexts ranging from voting and investing to everyday consumption choices, awareness of this bias can protect against following crowds into potentially harmful or suboptimal decisions.

Visual representation of Bandwagon Effect (click to enlarge)

Examples of Bandwagon Effect

Here are some real-world examples that demonstrate how this bias affects our thinking:

Investment Bubbles

During the cryptocurrency boom of 2017, many inexperienced investors rushed to buy Bitcoin after seeing its price skyrocket and hearing success stories from friends and media. Despite having little understanding of the technology or market dynamics, they invested significant amounts because "everyone else was doing it" and they feared missing out on potential gains. When the market eventually crashed in 2018, many who had jumped on the bandwagon suffered substantial losses because their decisions were based on social momentum rather than fundamental analysis.

Voting Cascade

In a local election, a candidate was polling at just 15% support early in the campaign. After a popular celebrity endorsed them, their numbers jumped to 22%. Media began covering this "surprising surge," which attracted more attention. Subsequent polls showed further increases, creating a perception of momentum. Undecided voters, seeing this candidate apparently gaining popularity, began supporting them too—not based on policy positions but because they appeared to be "the candidate everyone is getting behind." The candidate ultimately won with 51% of the vote, despite many supporters being unable to name their key policies.

How to Overcome Bandwagon Effect

Here are strategies to help you recognize and overcome this bias:

Set Your Decision Criteria First

Before looking at what others are doing, write down your own goals and evaluation criteria. This helps you stick to your reasoning instead of getting swept up by trends.

Make a habit of challenging the Crowd

When you see a popular opinion, ask: "What if this is wrong?" List counterarguments and possible flaws. This forces a fuller analysis and prevents blind agreement.

Test Your Understanding

Challenge yourself with these questions to see how well you understand this cognitive bias:

A stock market analyst notices that when his firm upgrades a stock rating from 'hold' to 'buy,' 73% of their clients purchase that stock within 48 hours, despite most not reading the detailed analysis. What cognitive process best explains this behavior?

Academic References

- Asch, S. E. (1951). Effects of group pressure upon the modification and distortion of judgments. Groups, leadership, and men, 222-236.

- Farjam, M. (2020). The bandwagon effect in an online voting experiment with real political organizations. International Journal of Public Opinion Research, 33(2), 412–421.

- Ho, J., & Mann, C. R. (2024). The Bandwagon Effect: Firm Choice and Selection in Research & Development. SSRN Electronic Journal.